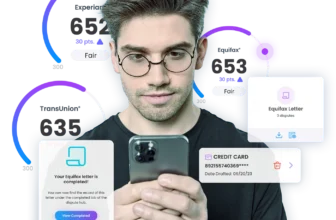

The Ultimate Guide to Strengthening Your Credit Score

A good credit score is a gateway to financial success, offering lower interest rates, better loan approvals, and increased financial security. Whether you’re just starting your credit journey or looking to improve your existing score, Credit Build is here to guide you every step of the way.

Why Your Credit Score Matters

Your credit score plays a crucial role in your financial health. Lenders use it to determine your creditworthiness, and it can impact:

- Loan approvals and interest rates

- Credit card eligibility

- Rental applications

- Insurance premiums

- Employment opportunities in some industries

If your credit score needs improvement, don’t worry—there are proven strategies to help you boost it effectively.

Steps to Build Credit from Scratch

If you have little or no credit history, these steps can set you on the right track:

1. Apply for a Starter Credit Card

A secured credit card or a student credit card can be a great way to begin your credit journey. Use it responsibly and pay off the balance in full each month.

2. Get a Credit-Builder Loan

These loans are specifically designed for individuals who are new to credit. Your payments are reported to credit bureaus, helping you build a positive credit history.

3. Become an Authorized User

Ask a family member with good credit to add you as an authorized user on their credit card. This can help establish your credit profile without requiring you to take on personal debt.

Ways to Improve Your Existing Credit Score

If you already have a credit history but need to improve your score, follow these essential tips:

1. Make On-Time Payments

Your payment history accounts for 35% of your credit score. Set up automatic payments to ensure you never miss a due date.

2. Reduce Your Credit Utilization Ratio

Try to keep your credit utilization below 30%. If possible, pay off balances in full to show lenders you can manage credit responsibly.

3. Dispute Credit Report Errors

Mistakes on your credit report can lower your score. Regularly review your credit report and dispute any inaccuracies you find.

4. Diversify Your Credit Portfolio

Lenders like to see a mix of credit types, such as credit cards, auto loans, and mortgages. Managing different types of credit responsibly can improve your score.

5. Limit Hard Inquiries

Every time you apply for a new credit card or loan, a hard inquiry is recorded on your report. Too many inquiries in a short period can lower your score, so apply for new credit only when necessary.

How Credit Build Can Help

Credit Build offers comprehensive tools and resources to assist you in achieving a strong credit score:

- Credit Score Monitoring: Stay informed about changes to your credit report.

- Personalized Credit Advice: Get tailored recommendations based on your financial situation.

- Educational Resources: Learn best practices for credit management through our blog and guides.

- Credit-Boosting Financial Products: Explore credit-building tools such as secured credit cards and credit-builder loans.

Final Thoughts

Improving your credit score is a gradual process that requires consistency and smart financial habits. By using the strategies outlined above and leveraging the resources at Credit Build, you can take control of your credit and unlock better financial opportunities.